-

Spoilers: No Country for Old Men

I read a lot of books and I read a lot of stuff on the internet. Sometimes I wish there was a better way to do these things together. There are communities online for so many things, and there are a lot of book-reading communities too, but somehow none of them work for me. Goodreads and various different subreddits are nice for finding new books to read, but there’s something that’s missing.

Sometimes when I finish a book, I am left with a rich, complicated, twisty set of thoughts in my head. I’m thinking to myself “That was a powerful book. Excellent. Now…” and then nothing. I want to discuss it with someone else who just finished reading the book at that very moment. But statistically maybe that person just doesn’t exist.

So, I will just write about it. What cripples this sort of conversation on most online forums is that 99% of the people interested in a particular book are people who are considering reading it, but haven’t read it yet. Probably 98% of those people won’t end up reading it. So the people with the most interesting thoughts on it have to dance around what they want to say, especially if the book is one where revealing secret information is a core part of the experience.

From here on out, any post with “Spoilers” in the title is just going to be chock-full of spoilers. Maybe this ruins the post for most of the potential audience. I am writing this post for the tiny number of people that has already read the book, No Country for Old Men, and wants to explore their own thoughts about it. If you happen to be willing to read about a book and accept that the plot will be spoiled, be my guest.

One extra point - if I write about a book in these “Spoilers” posts, that means I recommend that you read it. When I read a book I don’t like, I’m not going to bother writing about it.

On to the content.

No Country for Old Men

It is gripping. I made the mistake of starting this book a little bit before bedtime last night. It hooked me and I stayed up a couple hours later than I intended to reading it. The first 20 pages are intense.

I love the setting, of the Texas-Mexico border. Set in a time where a few of the characters are Vietnam veterans. There is a feeling of frontier emptiness. Like the characters are independent, free, simple, not really clicked into a society.

I don’t know if Cormac McCarthy uses a quotation mark in the whole book. The dialogue is stuff like:

What’s that? said Wendell.

Cylinder out of the lock.

Bell passed his hand over the plywood of the room-divider. Here’s where it hit at, he said. He balanced the piece of brass in his palm and looked toward the door. You could weigh this thing and measure the distance and the drop and calculate the speed.

I expect you could.

Pretty good speed.

Yessir. Pretty good speed.

They walked through the rooms. What do you think, Sheriff?

I believe they’ve done lit a shuck.

I do too.

Kindly in a hurry about it, too.

Yep.

There is a simplicity of form. He also seems pretty opposed to adverbs. Does it relate to other simplicity? The simplicity of the characters? Sometimes.

Characters

There are three main characters. Moss, the guy who finds two million dollars of drug cartel money, doesn’t do a lot of internal reflection. He doesn’t turn the money over when the police ask him to, and he doesn’t seem to reflect on it much, either. It feels like he just snap-decides.

Chigurh, the killer, we don’t see his thoughts in the novel. But he delivers psychopathic lectures before killing people. Flips a coin to decide whether he’ll kill them or not. Explains why, according to his way of seeing the world, he has to kill someone.

Bell, the sheriff, we see plenty of his thoughts. Chunks of the book are just him telling the reader about his life and thoughts.

It’s an odd thing when you come to think about it. The opportunities for abuse are just about everwhere. There’s no requirements in the Texas State Constitution for being a sheriff. Not a one. There is no such thing as a county law. You think about a job where you have pretty much the same authority as God and there is no requirements put upon you and you are charged with preservin nonexistent laws and you tell me if that’s peculiar or not. Because I say that it is. Does it work? Yes. Ninety percent of the time. It takes very little to govern good people. Very little. And bad people cant be governed at all. Or if they could I never heard of it.

I feel like simple sentences make some of the characters simpler. It’s easier to portray a quiet killer or a quiet cowboy type by just leaving out most of the descriptive words. But Bell’s thoughts touch on life and death and ask questions that aren’t simple to answer. Apostrophes not required.

The Drop

The real thing that makes this book a masterpiece is a huge twist near the end of the book. It feels like Moss is the protagonist, running from Chigurh. He’s the good guy, respecting his wife, taking a few risks, but generally smart and knows the land. You expect Moss to eventually escape with the money and be the guy who turns the tables on Chigurh. But no. The Mexican drug cartel simply kills everyone. Chigurh kills Moss’s wife, just to prove he’s the sort of guy that follows through when he threatens to kill someone’s wife. The drug cartel gets their money back. Bell can’t manage to catch anyone, can’t handle being the sheriff any more, and retires.

The book doesn’t even directly describe how Moss dies. For someone that feels like a protagonist for the first three quarters of the book, this is pretty crazy. I had to reread this section a few times to understand what was going on.

There’s three sections, separated by spaces that usually indicate a change of perspective. First section: Moss goes to bed, bidding good night to the hitchhiker he’s traveling with. Second section:

The Barracuda pulled into a truckstop outside of Balmorhea and drove into the bay of the adjoining carwash. The driver got out and shut the door and looked at it. There was blood and other matter streaked over the glass and over the sheetmetal and he walked out and got quarters from a change-machine and came back and put them in the slot and took down the wand from the rack and washed the car and rinsed it off and got back in and pulled out onto the highway going west.

This prose is really the opposite of David Foster Wallace. Instead of complicated words in forking trees of logic, it’s simple words that go from one simple activity to another simple activity. But it still creates a vivid picture. Terrible crime combined with everyday errands.

We haven’t seen a Barracuda (some car from the 60s/70s) before in the story. So all we know here is that someone is washing blood off their car. Some new character killed somebody. And then, the next section is Bell who stumbles across a new crime scene. He discovers that Moss was killed. Killed by a couple of characters that are presumably other employees of the drug cartel, who haven’t appeared in the story before this and don’t appear in the story again.

If it was a six year old writing a story, this sort of plot resolution would be unacceptable. But I can’t argue that it’s unfair. The irony is that Bell has been warning the whole time that Moss is going to get himself killed. And yet when it actually happened, I was taken by surprise.

Finally, although the main issue of the drug money is resolved, Chigurh hunts down Moss’s wife and kills her.

What does it mean?

Is it ridiculous how we expect novels to end happily? Maybe it weakens your mind for reading about real history, or analyzing the real world.

Is this more realistic? Drug cartels are still around, so in some sense they must be winning more battles than they are losing.

As the story ends, the only sympathetic thing remaining is Bell, reflecting on the meaningless deaths around him. I don’t often reflect on the presence of meaningless death in the world. It does seem like there is a lot of it, though. I have to give this novel credit.

When Moss took the money, I didn’t think too much about it. That sort of thing happens all the time in novels. By the end of the book, I realized that was his key mistake. He just never should have gotten involved. A chance at two million dollars wasn’t worth risking his decent life. And that’s a pretty legitimate conclusion, isn’t it? That seems to map to the real world. How can a novel have a lesson of “don’t risk your life for X” unless someone dies for it?

Somehow, after all this grisly drug violence, the book still makes me want to go out hiking through the Texas wasteland. But if I see a shot-out truck with a dead body inside, I’ll just call the cops. No need to investigate myself, first. Lesson learned.

-

How to 51% Attack Bitcoin

The core security model of Bitcoin is that it is very expensive to generate blocks of transactions. This means it is very expensive to attack Bitcoin by creating fraudulent transactions. Bitcoin miners can afford to invest a lot of money in hardware and electricity, because they are algorithmically rewarded when they do generate a new block.

Over time, the mining rewards decrease. Next year, in May 2020, the mining rewards will be cut in half. Eventually, there will be no more Bitcoin given as a block subsidy to miners, and the only payment to miners will be transaction fees. This naturally leads to some questions. Will Bitcoin still be secure when the mining rewards are cut in half next year? Will Bitcoin always remain secure, even after all the mining rewards run out?

Eli Dourado wrote a good analysis of this issue recently. He concludes, “At some point, the block subsidy will not be enough to guarantee security.” But I think we can be more specific. The way to analyze the security of Bitcoin is to look more closely at how a bad guy would attack it. So let’s do that. Our goal is to develop specific metrics for measuring the security of Bitcoin or other cryptocurrencies.

How much does it cost to attack Bitcoin?

The most straightforward way to attack Bitcoin is the 51% attack. Anyone can roll back all Bitcoin transactions that were confirmed over a recent time period. You just need more hash power than Bitcoin miners spent over that period. You can use that hash power to generate an alternate blockchain, and the Bitcoin algorithm guarantees that miners will respect your new blockchain over the “original” one. It’s called a “51% attack” because you need to have more than half of the hash power over some time period to perform it.

How expensive is this? A decent approximation is that the cost of generating an alternate blockchain is equal to the revenue made by miners. From blockchain.com we can get a chart of daily mining revenue over the past year:

Since miners are profitable, and this is how much money miners are making, this should be an upper bound on the cost of hashpower. It’s pretty volatile, somewhere between $5 million and $25 million per day. I find it easier to think in terms of hours, so somewhere from $200,000 to a million dollars an hour. (In practice, you cannot simply buy a million dollars worth of hashpower over a single hour. But the illiquidity of this market can’t really be relied on for security.)

So, a reasonable estimate for October 2019 is that it costs about a million dollars to roll back one hour of Bitcoin transactions.

How profitable is it to attack Bitcoin?

A million dollars sounds like a lot, but in the context of a financial system that processes billions of dollars, is it really a lot? The way to analyze security is to compare the cost of an attack with the profit of an attack. If profit is greater than cost, an attack is possible, so the system is insecure.

The way that a 51% attack makes money is by allowing the attackers to do a double spend. You spend your Bitcoin on something, then you use the 51% attack to roll back the blockchain, so you have your money again. You then spend that money on something else. So, you doubled your money.

“Spend” makes it sound like you are interacting with a merchant, like you are spending your Bitcoin on buying a pizza. In practice, criminals are not trying to spend a million dollars to get two million dollars worth of pizza. Rather than spending Bitcoin to get some consumer good, it makes more sense for an attacker to exchange their Bitcoin for some other sort of asset. The most logical asset is a different form of cryptocurrency. Let’s say Ethereum.

So the timeline for an attack could look like this:

- Start off with $X worth of Bitcoin in wallet A

- Move the Bitcoin from wallet A to wallet B

- Exchange all the Bitcoin in wallet B for $X of Ethereum

- 51% attack Bitcoin. Roll back the A -> B transaction. In the new chain, move the Bitcoin from wallet A to wallet C.

- The attacker now owns both $X of Ethereum and $X of Bitcoin in wallet C

The primary victim of a 51% attack is the exchange. The exchange delivered the Ethereum, but the transaction sending them Bitcoin is no longer valid.

The critical steps in analyzing profitability are steps 3 and 4. How long does it take to exchange the Bitcoin for Ethereum? How much can be exchanged by an untrusted attacker? If an untrusted attacker can exchange $2 million of Bitcoin for $2 million of Ethereum in an hour, and then spend $1 million to revert that transaction, the attack is profitable.

Some people have proposed security heuristics, like that mining revenue should be some percentage of the total transaction volume, or the total market cap. When we look at the mechanics of an attack, though, total transaction volume and total market cap aren’t relevant. The key question is how fast an attacker can exchange $X of Bitcoin for another asset. For this attack to be profitable, X has to be higher than the cost of the rollback, which is roughly equal to mining revenue over the rollback time.

For security against 51% attacks, the amount an attacker can exchange must be lower than mining revenue during the duration of the exchange.

In particular, Bitcoin’s security depends inversely on how fast it can be exchanged.

How fast can you exchange Bitcoin for another asset?

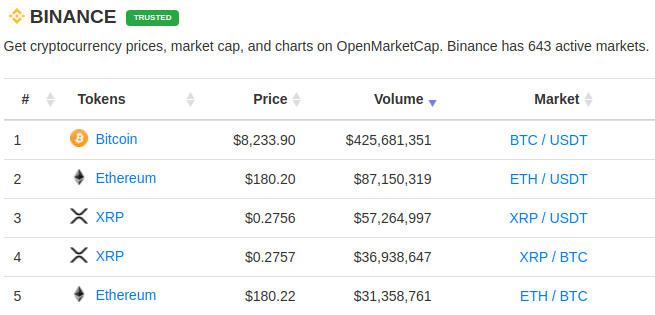

Binance is probably the largest exchange right now. Let’s use them as an example exchange - most exchanges have similar policies, but smaller volumes.

Binance recently updated their policy to consider transactions finalized within two blocks for Bitcoin, which is about 20 minutes, and 12 blocks for Ethereum, which is roughly three minutes. So the deposit and withdrawal phases of the exchange would take maybe half an hour.

The more time-consuming part might be the actual exchange of Bitcoin for Ethereum. Openmarketcap can show us the daily trading volume on Binance:

Per hour, that’s about $20 million of BTC / USDT changing hands, and $4 million of ETH / USDT. You wouldn’t be able to exchange $10 million of BTC to ETH in that hour without totally disrupting the market. If you were exchanging $100,000, that would just be a drop in the bucket. It’s hard to say without analyzing the order books more closely how much extra volume the exchange could support, but let’s estimate that a single trader could take up 10% of the total volume.

With this estimate, exchanging into ETH isn’t going to work. But you could exchange $4 million of BTC to USDT in two hours.

I expected when writing this post that I would conclude that Bitcoin is currently fundamentally secure. It doesn’t really seem that way, though!

The timeline for this hypothetical attack looks like this:

- Start off with $4 million of Bitcoin in wallet A

- Move the Bitcoin from wallet A to wallet B

- Deposit Bitcoin from wallet B into Binance

- Exchange it for USDT (takes about 2 hours)

- Withdraw the USDT

- 51% attack Bitcoin, rolling back the chain 2.5 hours, moving the contents of wallet A to wallet C.

- The attacker now has $4 million of Bitcoin in wallet C and $4 million of USDT

The attacker in this scenario spent $6.5 million to get $8 million. Binance is out $4 million, and $2.5 million got burned on redundant mining.

Why isn’t this attack happening right now?

There are three big assumptions that underly this analysis. The biggest assumption is that it is possible to acquire a large amount hash power for a short period of time. In practice, there is nobody who can sell you a million dollars worth of hash power over a single hour.

Can we rely on a market for hash power continuing to not exist? Maybe. This is essentially relying on large miners being unwilling to rent out their mining capacity. It doesn’t seem like the ideal foundation for security.

Altcoins are more at risk in this respect, because it is easier to acquire the amount of hash power needed to attack an altcoin.

The second big assumption is that the exchange will permit an untrustworthy attacker to quickly exchange a large amount of currency. If an exchange can prevent their customers from committing fraud in traditional ways, like knowing who they are and trusting normal law enforcement to prevent fraud, then the risk of a 51% attack is mitigated. Exchanges also might not let you deposit a large sum and immediately trade it. To avoid this, attackers might have to split these trades among multiple accounts or multiple exchanges.

Smaller exchanges that evade KYC regulation are probably more at risk here. Smaller exchanges might not have the volume to support an attack on Bitcoin, though, so this also means that altcoins are more at risk than Bitcoin is.

The final big assumption is that the value of cryptocurrency would not be affected by the attack. Perhaps a successful attack on Bitcoin would make the world world stop believing in Bitcoin and make all cryptocurrencies worthless. This isn’t something I would want to rely on, but it does mean, again, that altcoins are more at risk. If the 10th most popular cryptocurrency was attacked, it might have no impact on the price of Bitcoin.

All of these practical issues imply that altcoins are much easier to 51% attack than Bitcoin.

Altcoins are the canaries in the coal mine.

So which altcoins are in the most danger? This analysis only applies for proof-of-work coins, so whatever your opinion is on non-proof-of-work cryptocurrencies like XRP or EOS, this isn’t going to be a criticism of them.

Our rule for security is that a cryptocurrency becomes insecure when an attacker can trade more than mining revenue. We don’t know exactly how much a single attacker can exchange, but a reasonable assumption is that it is a certain fraction of the total exchange volume. This suggests that we can define a “danger factor” for cryptocurrencies. Call it D:

D = exchange volume / mining revenue

Or equivalently:

mining revenue = 1/D * exchange volume

Our previous security rule was that if an attacker can exchange more than mining revenue, the cryptocurrency is insecure. With this definition of D, we can rephrase that as:

If an attacker can exchange 1/D of total exchange volume, the cryptocurrency is vulnerable to a 51% attack.

A large value of D indicates that a currency has a high vulnerability to a 51% attack. D doesn’t have the same meaning for Bitcoin, since exchanging out of Bitcoin is limited by the volume of the altcoin, rather than the volume of Bitcoin itself. But for altcoins, D seems like a good proxy of risk.

The nice thing about D is that we can determine it from public information. I gathered some data for this table for ten of the larger proof-of-work altcoins. Mining revenue I got from bitinfocharts, although you have to click around a lot to get it. Exchange volume I got from openmarketcap. The data is just for today, October 7 2019.

Cryptocurrency Daily Exchange Volume Mining Revenue D Ethereum $234,357,917 $2,502,075 93.6 Bitcoin Cash $45,483,383 $412,722 110.2 Litecoin $52,306,855 $400,713 130.5 Bitcoin SV $2,426,079 $143,455 16.9 Monero $7,260,841 $91,483 79.3 Dash $2,639,938 $121,673 21.6 Ethereum Classic $7,188,482 $121,921 59.0 Dogecoin $451,196 $35,536 12.7 Zcash $4,571,311 $266,702 17.1 Bitcoin Gold $251,734 $14,783 17.0 This is just a snapshot of a single day of activity, so treat it as an estimate rather than a firm basis for decisionmaking, but based on this metric, Litecoin is the most vulnerable to a 51% attack, followed by Bitcoin Cash.

Ethereum is the next most vulnerable, so it is fortunate they are working on proof-of-stake. The cost of attacking the network should be significantly larger than the cost of attacking a proof-of-work network, relative to mining revenue.

For Bitcoin, the exchange is limited by the asset on the other end, rather than bitcoin itself. I would estimate its danger factor as D = 30, looking at the BTC/USDT exchange volume rather than the entire BTC exchange volume.

Conclusion

The risk of 51% attacks is real. Even today, for the security of Bitcoin we are trusting miners to not collude with each other, and trusting exchanges to catch fraudulent transactions.

However, the risk is worse for altcoins. Litecoin, Bitcoin Cash, Ethereum, Monero, and Ethereum Classic are especially at risk.

I believe that we will need to upgrade the algorithms behind popular cryptocurrencies to prevent 51% attacks. Ethereum moving to proof-of-stake is a good example. It might make sense to change Bitcoin’s consensus algorithm at some point, but there’s a lot at stake, so it makes sense to move conservatively. Let’s see what happens with the proof-of-work altcoins. If they do get attacked, perhaps it will make sense to alter the Bitcoin algorithm.

-

The Power Of Thinking Irrationally

I am intrigued by the idea that there may be more powerful ways to think, and by thinking about thinking itself we can upgrade our thought processes. But I am also intrigued by things that go against the conventional wisdom. So I was very curious recently to see Tyler Cowen’s criticism of the rationality community:

I would approve of them much more if they called themselves the irrationality community. Because it is just another kind of religion. A different set of ethoses. And there’s nothing wrong with that, but the notion that this is, like, the true, objective vantage point I find highly objectionable.

The idea of an irrationality community fascinates me. Who could possibly support irrationality? Is irrationality good for something? Could there be irrationality enthusiasts, eagerly swapping techniques for the most effective sort of irrationality?

What exactly is irrationality? From Wikipedia:

Irrationality is cognition, thinking, talking or acting without inclusion of rationality. It is more specifically described as an action or opinion given through inadequate use of reason, or through emotional distress or cognitive deficiency. The term is used, usually pejoratively, to describe thinking and actions that are, or appear to be, less useful, or more illogical than other more rational alternatives.

Actions that are backed by inadequate reasoning. Perhaps even actions taken without evidence, based purely on emotion. It sounds bad at first, but actually I think it is very valuable to act this way sometimes.

I don’t think rationality is bad per se. It’s more like, there are several modes of thinking. Sometimes it’s better to think in “rational mode”, and sometimes it’s better to think in “irrational mode”. Depending on the situation, you might want to switch from irrational to rational, like an MMA fighter switching from boxing to jiu-jitsu. (It’s similar to Thinking Fast And Slow, but I don’t necessarily think the irrational mode needs to be faster.)

So I mentioned that I thought rationality was overrated to someone, and they remarked that they were surprised, because I am a “mathy” person, that I would be the sort of person to dismiss rationality. But I think math is a great example where you want this sort of dual, sometimes-rational-sometimes-irrational thinking. Sometimes you work very rationally on a math problem - you see

x + 2 = 5, you want to solve forx, you recall an algorithm for this, you execute the steps one by one, the end. But for a tricky math problem, you might actually spend most of the time without reasons for what you do. You can just stew around in more of an “irrational brainstorming” mode, where you don’t have reasons or evidence, you just have loose fuzzy emotional heuristicky thinking, until you seize on what you think is a solution. And then you can toggle into “rational mode” to check the solution for validity, but still you spent the vast majority of your time in “irrational mode”.Let me go through an example. Here’s a math puzzle that someone just randomly asked to me while we were walking around once. It’s a question: can you pick five lattice points and connect each pair with line segments so that no other lattice points are on those line segments?

If you don’t know what a lattice point is, it’s just the points

(x, y)wherexandyare both integers. So the lattice points look like this:

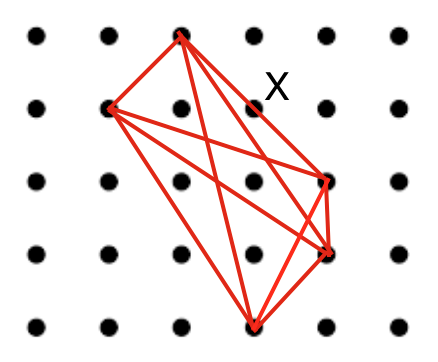

And a solution to the problem would look like this…

…except that the line segment marked with an X contains another lattice point. So in fact this isn’t a solution, and if you keep poking around by trial and error you will find it quite difficult to find a solution.

(If you want to solve this problem without me really getting spoilery, do it now without reading any further.)

This sort of problem doesn’t require any advanced math, but it doesn’t map to any sort of math problem you drilled on in high school. Some people will just read this problem description, and then, nothing pops into their head. Or they trial and error a few times, fail, and then don’t know what else to do. They will just stare blankly at the problem and not know what to think about next.

When this happens to you, rational thinking is worthless. If you don’t have any evidence to start out with, you can’t start making rational conclusions. So when you find yourself totally stuck, thinking no thoughts at all, that is your mental cue to switch into irrational mode. You’re too far away to grapple - use boxing instead of jiu-jitsu.

To think irrationally about this problem, just don’t worry about logical connections making sense. Feel out for any emotions about the problem that you have and assume they are axioms. Think of other things that this reminds you of. If A implies B, and you know B is true, imagine for a second that that implies A. Let yourself use some logical fallacies. Just see if those lead you somewhere interesting.

At this point, I would come to irrational conclusions like:

-

I tried to do it several times and could not. Therefore it is impossible.

-

Since the graph connecting 5 points is nonplanar, and these lattice points are in the plane, it also cannot be embedded into lattice points.

-

The number 5 is very ugly so it causes the math to fail.

-

Lattice points are made up of squares, and the square’s favorite number is 4, so 4 can work but not 5.

-

You can jam four things in there but there just isn’t enough room to jam five things in there.

These conclusions are not based on evidence, they are not based on logical arguments, they are not really logically correct, they are tainted with all sorts of emotions and biases, and at least one is just totally wrong. But they are useful because they are maybe correct, more likely than 0% chance correct, and they give you sparks to continue. And they are not just useful inside one person’s head - if you have multiple math-problem-solvers brainstorming, it’s useful to share these half-thoughts with each other. You have to trust your collaborators to be fairly intelligent. But when you are in a group you trust, it can really help you to accept some irrational conclusions. And that principle goes beyond solving math problems.

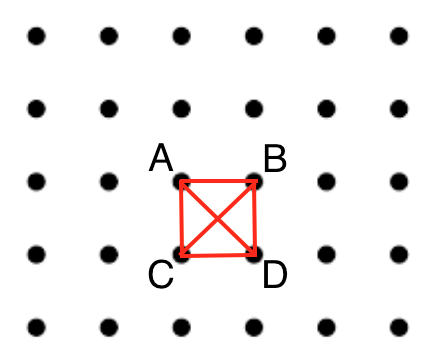

Anyway, some of these irrational conclusions can be the seed of a rational proof. Perhaps the “not enough room to jam it in there” reminds you of the pigeonhole principle and the answer comes to you in a flash. Or perhaps the five-versus-four and squares-are-beautiful aspects lead you to think about a very simple way to solve it for four points, and ponder deeply why this particular solution can’t be extended to five points:

Why can’t this be extended to five points? This example is simple enough that you can try extensions in your head and label each new point by which of these four original points it conflicts with. You will get lattice points labeled like:

A B A B A B C D C D C D A B A B A B C D C D C D A B A B A BYou can’t have more than one

Ain your five points, and actually that is true even if you didn’t start with the simple square, if you think about it.(I’m not quite sure how much my blog audience would like me to spell out the math here, but perhaps I’ll leave it at this.)

I suspect that most people who are trying hard to get better at math, or at similar skills like programming problem-solving, are actually not struggling with the “rational” part, of rigorously proving something works. They are struggling with the “irrational” part, of how do they make progress when they are unable to make rational conclusions. So don’t feel like it’s dirty or inappropriate. Thinking irrationally can be another useful tool in your toolbox. Embrace it, and let me know what irrational techniques work for you.

-

-

Silicon Valley's Manifest Destiny

Silicon Valley is famous for having things with nonsensical names. It’s not just the startups, it’s also the place names. For example, “Mountain View”. Here’s a view from a field right next to Google’s main campus. It seems… pretty flat. How do you arrive in this place, look around, and think, I know, I’ll call this “Mountain View”?

So for a long time I assumed “Silicon Valley” didn’t mean anything. It doesn’t feel like a valley, it feels like a flat area that’s next to a bay. This is the sort of trivia that I ignore for a decade, and then one day in a fit of random curiosity look it up on Wikipedia, and lo and behold it is actually named after a valley:

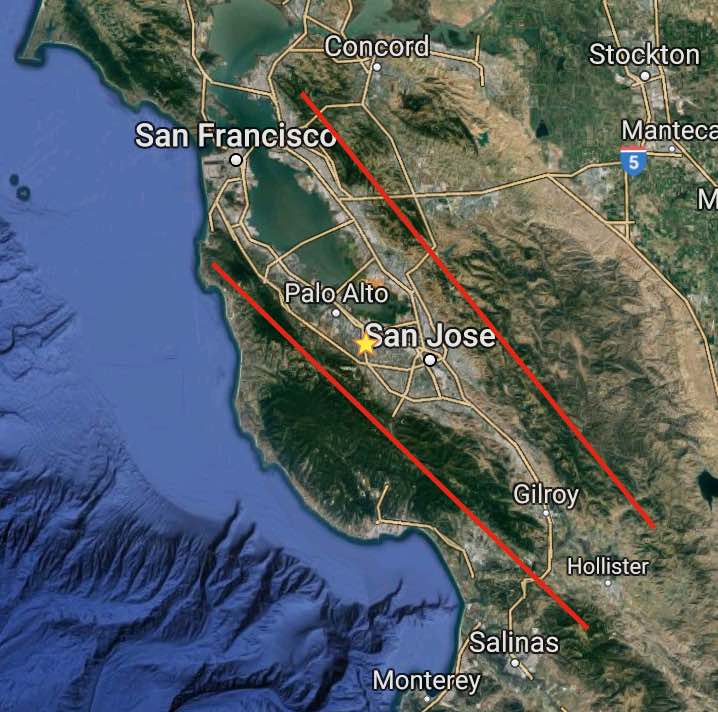

Silicon Valley is a nickname for the southern portion of the San Francisco Bay Area, in the northern part of the U.S. state of California. The “valley” in its name refers to the Santa Clara Valley in Santa Clara County, which includes the city of San Jose and surrounding cities and towns, where the region has been traditionally centered.

This naturally leads to the question of what counts as the Santa Clara Valley. Wikipedia again:

The valley is bounded by the Santa Cruz Mountains on the southwest, which separate Santa Clara Valley from the Pacific Ocean, and by the Diablo Range on the northeast.

Here’s a diagram:

The Santa Cruz Mountains, on the left, are the same mountains you can’t quite view from Mountain View.

Originally the “valley” referred to the area San Jose and southwards. Its industry-specific nickname was the “Valley of Heart’s Delight”, because until the 60’s it was the largest fruit production region in the world. Then that all got displaced by tech companies, which makes the name “Apple” seem a bit less friendly and a bit more passive-aggressive.

Nowadays the area considered Silicon Valley has expanded to include the stretch from Palo Alto to San Francisco. But in a sense it’s still a valley between the Santa Cruz Mountains and the Diablo Range. It’s just a really big valley so you can’t necessarily see its valley-ness while you are in it.

So Silicon Valley is sprawling. Where will it stop? My theory is that Silicon Valley will inevitably expand to fill all of the space between these mountain ranges, like a modern version of Manifest Destiny. Imagine Oakland, San Leandro, Fremont, and Gilroy all steadily invaded by an army of techies.

Why Silicon Valley’s Manifest Destiny Is to Fill Up The Physical Valley

-

Rent. This is the obvious one, everywhere from San Francisco to San Jose is getting more and more expensive.

-

Nominative determinism. The word “valley” is part the phrase “Silicon Valley”. Therefore, mystical grammatical fate will drive them together. There is a certain magic to saying, yes we’re located in Silicon Valley. I think you can say that with good faith if your company is located in San Leandro or Gilroy. If someone complains, point to this picture of the mountain ranges.

-

Software is eating the world. There are still lots of non-tech-dominated industries. If we keep eating those industries a la Uber and Airbnb, and Silicon Valley keeps having most of the eaters, we will have more and more massive companies in Silicon Valley and need more space to put them.

-

Self-driving cars. It takes two hours to commute from Gilroy to Menlo Park. If self-driving cars make a two-hour commute something that isn’t too bad, all of a sudden Gilroy is a much nicer place to live.

I think this last reason is underrated. Imagine a world where your car is a great place to work. Sure you can have a two-hour commute. Just hop in your car at 8, get to work at 10, leave work at 4, get home at 6, and hey that’s a 10-hour work day because your car is just a one-person office on wheels. You can put your in-person meetings from 10 to 4 so you don’t have that “remote office” feeling of not actually sitting next to your coworkers. So why bother living closer than two hours to the office?

Recently I have read a number of interesting analyses theorizing what the good investment opportunities are, if self-driving cars work out. Perhaps a simple answer here is “Gilroy real estate”.

-

-

Why You Can't Say

Recently on a tip from Ivan Kirigin I reread this now-ancient Paul Graham article, What You Can’t Say. Like the idea of Straussian reading, the essay is looking for secret truths which are currently inappropriate to share publicly.

It’s tantalizing to think we believe things that people in the future will find ridiculous. What would someone coming back to visit us in a time machine have to be careful not to say? That’s what I want to study here. But I want to do more than just shock everyone with the heresy du jour. I want to find general recipes for discovering what you can’t say, in any era.

At first I was going to dig in, follow the instructions in this essay, perhaps try to get meta and turn them on the essay itself, and find some secret truths. But there was just too much to bite off at once and I ended up gnawing on a tangent.

Specifically, the part that really sparked some thought for me was this hypothesis on the source of taboos:

To launch a taboo, a group has to be poised halfway between weakness and power. A confident group doesn’t need taboos to protect it. It’s not considered improper to make disparaging remarks about Americans, or the English. And yet a group has to be powerful enough to enforce a taboo.

I suspect the biggest source of moral taboos will turn out to be power struggles in which one side only barely has the upper hand. That’s where you’ll find a group powerful enough to enforce taboos, but weak enough to need them.

I’m not totally convinced that most moral taboos come from power struggles. My personal suspicion is that the best explanation of the source of moral taboos comes from the theory of social constructionism:

Human beings rationalize their experience by creating models of the social world and share and reify these models through language.

Basically, some truths you believe because they are inherently logical. If at least one of Alice, Bob and Eve has a wrench in their pocket, but Alice and Bob have no pockets, then Eve has the wrench. Some truths you believe because there is empirical evidence. The Earth is round because I saw it on the SpaceX video. But some truths you believe just because other people believe them.

Instinctively you might think, oh ho that is one of the 147 types of bad arguments. But in practice there are a zillion things you believe not because of logic, but because other people told you to.

- You shouldn’t eat mud

- Red lights mean stop

- Human life is a precious thing

Lots of useful and totally true facts about the world are socially constructed.

This can lead to a taboo situation, though. A small group believes X. A much larger group believes Not X. Since both of these truths are socially constructed, there’s no baseline reality. There’s no way to have an intelligent debate. So the larger group turns into an angry internet mob and shouts down the smaller group.

I believe the topic of startup advice is particularly vulnerable to this phenomenon. You cannot deduce the principles of running a startup from first principles. One effective mechanism is to learn what worked for successful startup founders - to seek out their socially constructed truth. But that’s a pretty small group. In particular, the set of all people in tech industry is a much larger group. Sometimes these groups have opposing socially constructed truths.

Here’s an example: whiteboard interviews. Are whiteboard interviews a good strategy for interviewing people, or a bad strategy for interviewing people?

Go read mainstream tech news or social media and you will conclude that whiteboard interviews are terrible. From the first few search results for “whiteboard interviews”:

The mainstream conclusion is clearly that whiteboard interviews are a bad idea. But on the other hand:

The most successful companies all use whiteboard interviews. It’s not just the top big companies, it’s the top late stage startups, top early stage startups, the top tier at every point. Nevertheless, the median tech internet is opposed. What’s happening here?

I think the fundamental discord comes from the nature of interviewing. For example, Google accepts under 1% of job applicants. And yet Google has 70,000 employees. If my simplistic math holds up, they have rejected over 7 million people.

Personally, when I go apply for a job, I think of it like an axiom that I deserve that job. When I get rejected I usually conclude the company is either morons or evil or perhaps if the interviewers were very kind I will be charitable and just conclude that it’s a flawed process. So yeah, I can see how there would be 7 million people out there convinced that Google interviews are a flawed process. They know they are correct because their friends mostly agree with them. But I don’t think Larry is kicking himself wishing they had never adopted the whiteboard interview.

What is really a shame, though, is that once I had a conversation with a startup CTO that went like this:

Me: So how’s recruiting?

CTO: Going great, not having any trouble finding software engineers.

Me: Wow, I don’t hear that often.

CTO: Yeah, once we raised we needed 8 people and we hired them in a month.

Me: Double wow. How did your tiny team even do enough interviews to hire 8 people in a month?

CTO: Oh, we only had to interview 9 people.

Me: Uh oh. How did you interview them?

CTO: Well as everyone knows, whiteboard interviews are terrible, so we just kind of chatted about their past experience.

Me: Oh no.

CTO: I have a really good feeling about this.

So, be careful about taking the median startup advice. You might end up with the median outcome.